How to get into the retirement comfort zone

A third of Australians retire without a plan. Here's why you should have one.

Working and generating a stable income can be described as a comfort zone for most Australians.

The same can be said for having a well-considered retirement plan that clearly identifies your current financial position and outlines what it will take for you to achieve your desired retirement lifestyle.

Yet, Vanguard’s 2024 How Australia Retires research has found that 40% of Australians do not have a clear retirement plan (either formal or informal). In addition, 29% have a basic plan but only have some of the details worked out.

More than 1,800 Australians aged 18 years and over participated in the retirement research, which was conducted in March this year.

Of the total population surveyed, 31% said they had a plan in place around how to achieve their desired lifestyle. They were also the most confident when it comes to retirement and more likely to have a clear budget, make additional contributions to their superannuation, and make regular savings outside of super compared to those without a clear plan.

A third of retirees don’t have a plan

Vanguard’s research found one in three people in retirement did not have a plan when they retired.

Only 39% cited being well planned and having an exact or good idea of what they needed financially to achieve the lifestyle they envisioned in retirement.

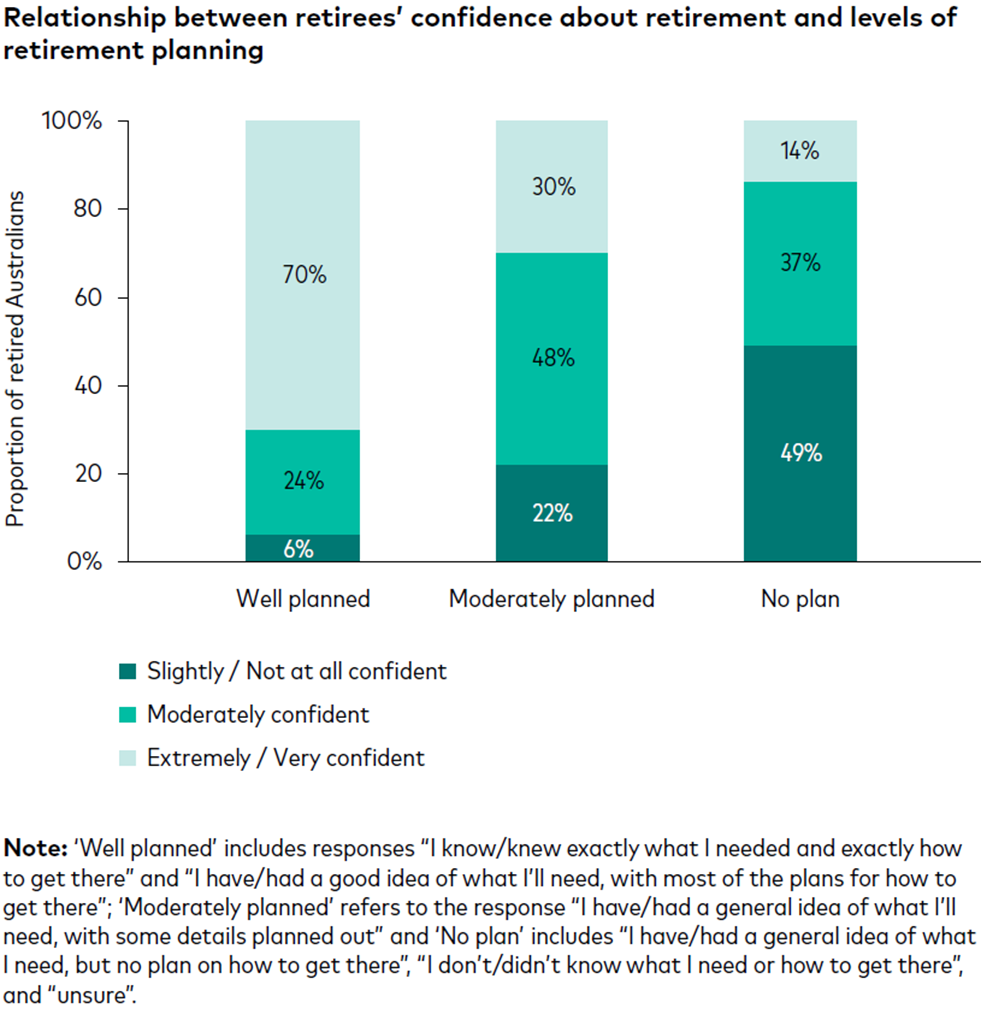

Retirees who were well planned and knew exactly or had a good idea of what actions they need to take to prepare for retirement are four-times more likely to be highly confident about retirement than those who did not have a plan upon retiring.

This finding is consistent with the 2023 How Australia Retires survey on the positive impact retirement planning can have on retirement confidence.

Planning for retirement

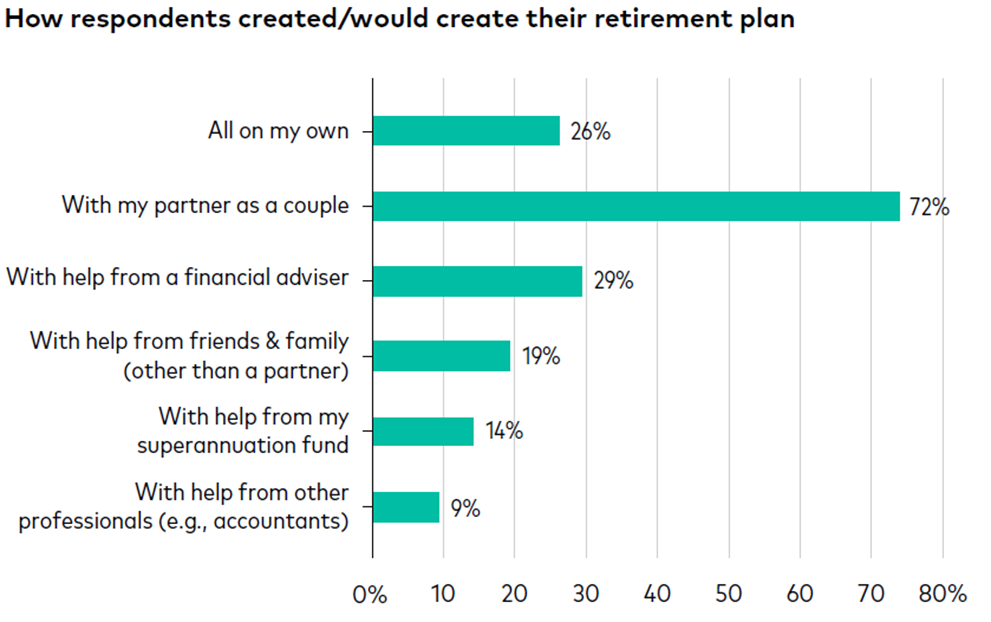

How Australians are planning for retirement varies greatly, with the most common approach among working-age and retired Australians to plan in conjunction with a partner.

Just under 30% sought or would seek retirement planning help from a financial adviser, but one-in-four said they preferred to plan on their own.

Australians who said they were very or extremely confident about retirement were the most likely to have sought retirement planning support from a financial adviser (33%, compared to 29% of Australians moderately confident about retirement, and 23% of Australians slightly or not at all confident about retirement).

This suggests seeking professional financial advice may have a positive impact on the confidence one gains from the retirement planning process.

Government reviews and industry research have highlighted that an advice gap exists in Australia where many do not have access to quality and affordable financial advice.

While Vanguard considers that quality financial advice is critical at retirement, we also see value in its ability to positively guide actions and behaviours in the years, and even decades, leading up to retirement.

Building wealth is a long-term initiative – the earlier Australians access advice, the more opportunity there will be for any benefit of that advice to positively impact financial and retirement outcomes.

Good financial advice can also improve more than just returns and go beyond portfolio and financial value. Importantly, it can improve financial peace of mind and preparation, with 37% of advised Australians feeling highly confident about retirement and 43% having a clear retirement plan.

In contrast, only 24% of non-advised Australians feel highly confident about retirement and just 19% have a clear retirement plan.

Source: