Women and Superannuation

In Australia, women tend to have lower superannuation balances than men, but they also tend to live longer. This can lead to a greater reliance on the aged pension for women and reduced independence.

Women and Superannuation

In Australia, women tend to have lower superannuation balances than men, but they also tend to live longer. This can lead to a greater reliance on the aged pension for women and reduced independence.

Why do women tend to have lower superannuation balances?

- Woman are more likely to have their working life interrupted by maternity leave and time off to raise a family.

- Women are more likely to work part-time or fewer hours. According to recently released statistics, usual weekly hours worked for men is 38.8 hours, whilst it is 32.1 hours for women (2).

- Women, on average, earn less then men. Recently released figures from the ATO(1) reveal that the average taxable income for a female in 2021-22 was $60,054, compared to males at $84,326. That is a 40% difference.

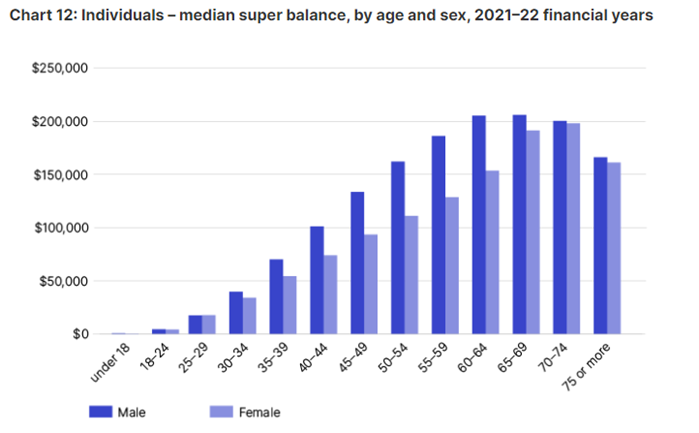

Consequently, women end up with less money in their superannuation account and hence less money in retirement. The average super balance for men is $164,126, whilst for women it is $146,146 (1). This puts women more at risk of having to rely on the aged pension.

Source: ATO Taxation Statistics 2021-22.

What can you do?

Make sure you are invested in the right investment option

When choosing an investment option that is right for you, you should consider your:

- Age

- What level of investment risk you are comfortable with

- When you will be able to access your funds

- How much money you want in retirement

Consolidate your super

Consolidating your super into one account means that you are only paying one set of fees. This will save you money and mean that you have more money in your superannuation account for your retirement. Before you consolidate your super, be sure to check fees and if you will lose any benefits like insurance.

- More information can be found on the government’s moneysmart website.

Make additional contributions

Your account balance will be boosted through any contributions that you and/or your employer make.

Government Boosters to your superannuation

Low Income Tax Offset

Did you know that if you earn $37,000 or less a year you may be eligible for the Low-Income Super Tax Offset (LISTO). This is a government payment of up to $500 that is made directly to your superannuation account. All you need to do is make sure that

- your super fund has your tax file number – without it, your super fund can’t accept a payment

- you lodge your tax return so the government can work out your payment.

Government Co-contributions

If you are a low or middle-income earner, you can take advantage of the co-contribution payment by making a personal contribution into your super fund. Depending on your income and how much you contribute, the government will then match your contribution up to a maximum of $500.

More information can be found on the ATO website.

Source:

- ATO Taxation Statistics 2021-22

- Australian Bureau of Statistics (current), Gender indicators - https://www.abs.gov.au/statistics/people/people-and-communities/gender-indicators

- https://moneysmart.gov.au/how-super-works/consolidating-super-funds

- https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/super/growing-and-keeping-track-of-your-super/how-to-save-more-in-your-super/government-super-contributions/super-co-contribution