Working longer or retiring earlier: Australia’s retirement reality

When Australians are choosing to retire comes down to a range of factors.

Vanguard’s 2024 How Australia Retires research found that nearly 50% of retirees have retired earlier than they would have thought.

The average retirement age reported by retirees was 61 years old, while working age Australians reported an average ideal retirement age of 62.6 but an average realistic retirement age of 67.9.

Retirees who had been less confident in their retirement plans were more likely to have retired earlier than expected (62%) compared to highly confident retirees (40%).

This could be due to several factors such as health issues or care obligations.

Retiring earlier than expected can have financial implications as it impacts one of the most common yet complex questions to answer in retirement: Will my money last?

Vanguard has found that retirees who are well planned and know exactly or have a good idea of what actions they need to take to prepare for retirement are four-times more likely to be highly confident about retirement than those who do not have a plan upon retiring.

Meanwhile, new research by the Association of Superannuation Funds of Australia (ASFA) has found that a growing proportion of Australians plan to keep working past the age of 65.

Of those aged 65 or over and still working, around 25% of those surveyed plan to keep working to stay socially engaged. Around 14% believe they will never be able to retire, largely due to financial reasons.

Longevity risk is a growing concern

A key factor feeding into the fear of running out of money in retirement is the ongoing increases in average life expectancy rates.

One in two of the more than 1,800 Australians aged 18 years and over who participated in Vanguard’s retirement research said they did not know whether their money will last in retirement.

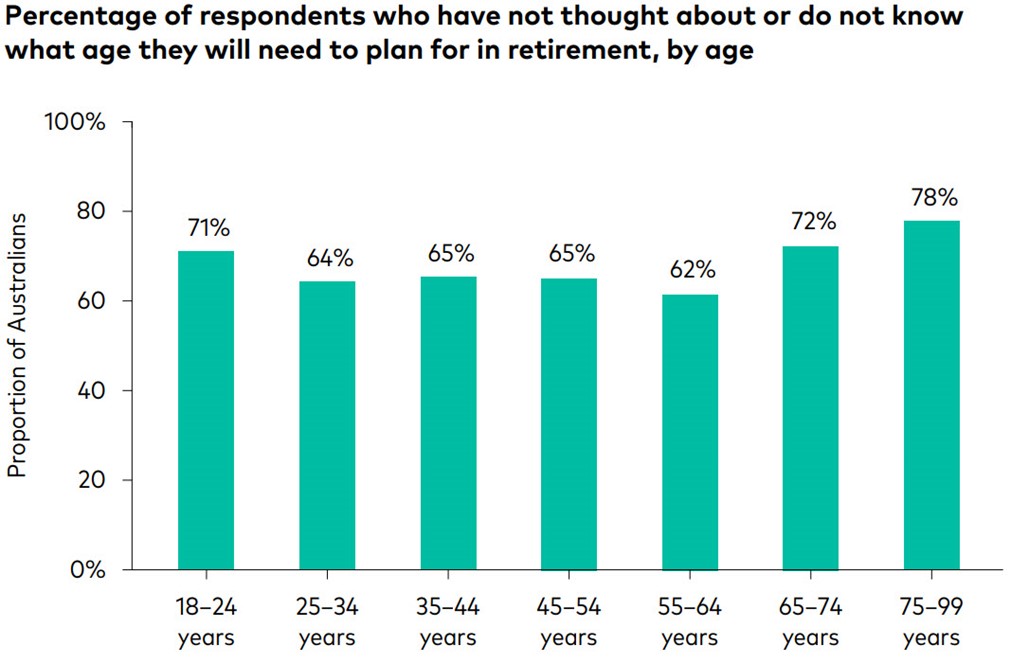

Of the 67% of Australians who have not thought about or don’t know what age they will need to financially plan for in terms of their retirement, many are in the older age brackets.

Vanguard’s research found this percentage is highest for those aged 65 to 74 years old (72%) and 75 to 99 years old (78%).

Source: Vanguard

Almost three in five retirees believe they have a 40% or greater likelihood of outliving their retirement savings. Additionally, almost one in five retirees believe they are at significant risk, with a perceived 90% or greater likelihood of running out.

Perhaps more concerningly, one in two retirees do not know how much they can spend each year in order to not outlive their savings.

Building retirement confidence

Australians in Vanguard’s research who said they were very or extremely confident about retirement were the most likely to have sought retirement planning support from a financial adviser (33%, compared to 29% of Australians moderately confident about retirement, and 23% of Australians slightly or not at all confident about retirement).

This suggests seeking professional financial advice may have a positive impact on the confidence one gains from the retirement planning process.

Government reviews and industry research have highlighted that an advice gap exists in Australia where many do not have access to quality and affordable financial advice.

While Vanguard considers that quality financial advice is critical at retirement, we also see value in its ability to positively guide actions and behaviours in the years, and even decades, leading up to retirement.

Building wealth is a long-term initiative – the earlier Australians access advice, the more opportunity there will be for any benefit of that advice to positively impact financial and retirement outcomes.

Good financial advice can also improve more than just returns and go beyond portfolio and financial value. Importantly, it can improve financial peace of mind and preparation, with 37% of advised Australians feeling highly confident about retirement and 43% having a clear retirement plan.

If you compare your super fees with those of other super providers it’s important to make sure you are comparing like for like.

The three main categories of super fees are administration fees and costs; investment fees and costs; and transaction costs.

Administration fees and costs

Super funds charge administration fees to cover the costs associated with administrating and operating your super account. These fees are often levied at a fixed percentage rate based on your current account balance.

All super fund trustees also have a legislative requirement to fund and maintain an Operational Risk Financial Requirement (ORFR). This fee is normally charged monthly to members and is recorded on annual statements as an ORFR Admin Fee for Vanguard Super.

Investment fees and costs

Investment fees typically relate to the costs involved in managing the investment options you have chosen within your super fund and may vary between different options. These can include investment management costs based on your asset allocations and costs levied by third parties. They are usually deducted from investment returns before they are applied to your account.

Some super funds charge “performance fees” on their MySuper default options if their investment returns exceed a target level stipulated in their PDS. These typically relate to fees that are charged by third party active investment managers.

Performance fees are normally charged based on a set percentage of an investment return that is above the specified target level and are lumped into the investment fees category. To determine the percentage or costs associated with performance fees super fund members generally need to read the fine print of their fund’s relevant PDS.

Vanguard Super is the only fund that does not have a performance fee and has a single yearly 0.56% fee made up of administration, investment, and transaction fees and costs.

Transaction costs

Transaction costs are generally incurred as part of daily investment management activities to buy and sell underlying assets held by the super fund. They will also usually be deducted from investment returns before they are applied to your account and do not appear as specific items in your record of account activity.

Other fees and costs

Super funds also typically charge a buy/sell spread to recover the cost whenever you make a contribution, withdrawal, or switch investment options. The buy/sell spread is the difference between the buying and selling of the underlying investments. The buy/sell spread charged depends on your investment option and the number of transactions you make.

Some super funds can also charge switching fees if you decide to switch between different investment options, such as from a growth to a balanced asset allocation strategy.

Insurance fees (for default death and total permanent disability (TPD) cover) will also apply unless you decide to opt out of the cover. These fees are generally payable on a monthly basis and deducted from your account balance.

Lastly, where personal financial advice is provided by a licensed financial adviser, advice fees can be levied and, with your consent, can be paid via a deduction from your super account.

While this may all seem daunting, and not easily understood, one way you can check on the total fees that you have been charged throughout the course of the year is to review your member statement.

Compare apples with apples

If you compare your super fees with those of other super providers it’s important to make sure you are comparing like for like, especially as different super funds tend to have a range of investment options charging different fee levels.

A good starting point is to check investment options that are closest to the allocations you have in your current super fund. You may need to investigate what other super funds are investing in, and their percentage allocations.

Source:

https://www.vanguard.com.au/personal/learn/smart-investing/retirement/australias-retirement-reality

https://www.vanguard.com.au/super/performance-and-fees/fees/superannuation