How many assets can you have and still be eligible for the Age Pension?

There are two basic hurdles you have to pass before you become eligible for the Age Pension – the income test and the assets test.

We will just be talking about the assets test here, because that’s our subject, but if you want to learn about the income test please contact us.

So back to the assets test.

What exactly is it? Well, the assets test sets out how many assets you can own and still be eligible for the Age Pension. Go above that limit and you may only get part payments or no payments at all.

Assets included in the assets test include:

- financial investments including shares and securities

- home contents, personal effects, vehicles and other personal assets

- managed investments and superannuation

- real estate

- annuities, income streams and superannuation pensions

- shares

- gifting

- sole traders, partnerships, private trusts and private companies

- deceased estates.

Centrelink also takes into account any assets you and your partner, if you have one, own overseas and any debts owed to you.

The following are the asset limits.

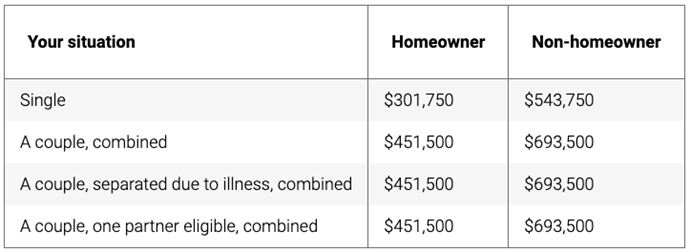

Limits for a full Age Pension

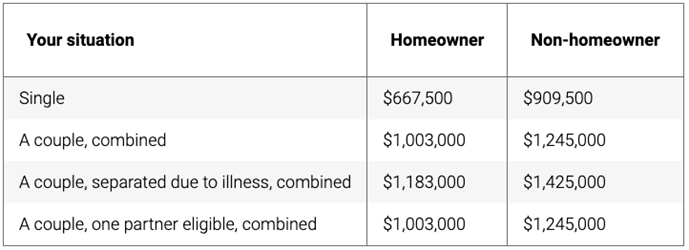

Limits for a part Age Pension

What’s not included in the assets test is your primary residence and up to two hectares on the same title and some funeral bonds and prepaid funerals.

Some rural landowners also have exceptions if they meet certain conditions, including:

- they have reached pension age

- have lived there for the past 20 years or more

- pass the land use test.

The land use test is about not forcing people off their land to gain a retirement income. The Australian government does not believe older Australians on farms and rural residential areas should have to move from their principal home, where they have lived for a long time, to gain an adequate retirement income.

According to the Department of Social Security, the extended land use test is designed to enable people of Age Pension age with a long-term attachment to their land and principal home to stay in their home into their retirement. To do this, the person must make effective use of productive land to generate an income, given their capacity.

“If a person is eligible to have the extended land use test applied they can have the area of land adjacent to the principal home, that is more than two hectares and held on one title document, exempt from the assets test provided they are making effective use of the land,” the ruling states.

If your eligibility for the Age Pension does rely on the assets test, it’s worth noting the Department of Social Services reviews these limits and cut off points in March, July and September each year.

It’s a good idea to contact us to check these dates as you may sneak under the limit.

If your asset level changes, say for example if you sell your principal home, you must let Centrelink know within 14 days.

You can let Centrelink know through your myGov account if you have one or through:

If you don’t have access to a self-service option, you can call us and we will help.

How to reduce your assets to pass the assets test

There are a few simple ways. If we haven’t already discussed funeral bonds or prepaid funerals with you as a way to reducing your assessable assets you should give us a call.

You can revalue your assets. Unless your vehicles and personal assets such as furniture and jewellery are of exceptional quality, chances are they are worth a fraction of their original value. Centrelink only considers ‘market price’, so you can value them at what you could expect to sell them for on Facebook marketplace or a garage sale. If you spend a little time online you will find even stunning antiques are only selling for a few hundred dollars each.

As your principal home is exempt from the assets test you can pay for some renovations. This would transfer any cash you have into your house, increasing its value and decreasing your bank account.

You can gift money or assets. However, the government doesn’t like you just giving money away to qualify for the Age Pension, there are some strict rules.

The maximum allowable value of the gift is the same if you’re a single person or a couple. They are both:

- $10,000 in one financial year

- $30,000 over five financial years – this can’t include more than $10,000 in a single financial year.

Centrelink doesn’t just consider financial gifts, it also takes into consideration the value of gifts such as a car.

Please always remember that you are welcome to contact us at any time if you would like to discuss anything you have read.