Giving your portfolio a caffeine inspired boost

With interest rates likely to fall this year, borrowers could invest some or all of their mortgage repayment savings.

Inflation may be coming off its high, but the retail price of coffee isn’t likely to lose any monetary steam.

Depending on where you buy, the average cost across Australia of a regular-size takeaway cup of coffee is now around $5. For those needing a daily fix, that equates to $35 per week.

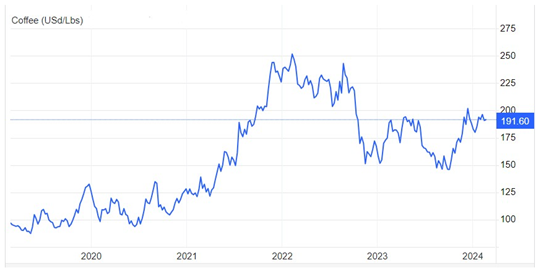

The chart below isn’t the Australian share market. It’s the wholesale price of coffee since the start of 2019.

The caffeine hit

Source: Trading Economics

Source: Trading Economics

The sharp rise in coffee prices has been the key driver behind a worldwide surge in coffee machine sales. Many coffee consumers are now choosing to reduce their intake of café takeaways by making their own at home or in the office. It’s a small way to reduce everyday living expenses.

Of course, coffee isn’t the only thing on an inflation-induced high. Average monthly mortgage payments have also effectively doubled for many households since the Reserve Bank began rapidly raising interest rates in May 2022.

But there’s a big difference. Unlike the price of a cup of coffee, borrowers should see a price reduction later this year based on forecasts that banks will start reducing their interest rates in the second half. Lower rates will add up to big cash injections for many borrowers as their monthly repayments fall.

And this raises an important question. Should borrowers continue paying down their home loan at the same, current higher repayment rate, or would it be better to redeploy some or all of those expected mortgage savings another way?

Paying extra off the mortgage

Borrowers generally have two choices when interest rates are reduced. They can choose to pay a lower monthly repayment rate based on their outstanding loan balance, or they can maintain their repayments at the previous rate.

For example, a borrower paying off a $400,000 principal and interest mortgage over 25 years would currently be making repayments of just over $2,701 per month based on a mortgage interest rate of 6.5% per annum.

A reduction in the mortgage interest rate to 6% would see monthly repayments fall to $2,577, a saving of $124 per month.

By maintaining repayments at $2,701 per month, a borrower would pay off their loan in 22 years and seven months, reducing their loan term by almost two-and-a-half years.

Reducing the amount owing on a loan will reduce monthly repayments, the interest charges on the outstanding balance and, most likely, the overall term of a loan.

On the other hand, investing additional funds into other areas can potentially offset the debt-servicing costs of a loan over time if the net returns from those investments are higher.

An alternative pathway

When interest rates do eventually begin to fall, an option for borrowers could be to invest some or all of their monthly mortgage repayment savings.

If the average interest rate on a variable rate owner-occupied home loan over its term was 5%, while the net returns from an investment over the same period of time was 9%, then one could build a case that investing surplus funds may be a better path.

The 2023 Vanguard Index Chart shows that the Australian share market, measured by the S&P/ASX All Ordinaries Total Return Index, returned an average of 9.2% per annum over the 30-year period from 1 July 1993 to 30 June 2023.

Over the 10 years from 1 January 2014 to 31 December 2023 the Australian share market, measured by the All Ordinaries Total Accumulation Index, achieved an average return of 8.2% per annum.

It should be noted that it is impossible to predict future share market returns, and past performance is not an indicator of future performance.

The following example is based on a hypothetical person having invested $124 per month from 1 January 2014, capturing the average return of the Australian share market to 31 December 2023.

Over the decade they would have made 120 monthly payments worth a total of $14,880.

However, factoring in the growth and income returns from the Australian share market over the decade, their balance would have surged to $22,829. That’s a total gain of around $8,000.*

Do your homework

There are a range of things to consider based on one’s personal circumstances before deciding whether to pay down debt or to direct extra money into investments. There is no one-size fits all approach.

Investment returns can be volatile, and some asset classes can deliver low or negative returns, resulting in a potential loss of income and the principal invested. As such, depending on the mortgage interest rate being paid, borrowers may not be able to achieve an investment return that is high enough to compensate for the additional interest being paid.

If in doubt, a financial adviser can take into account all your specific characteristics and help define the best course of action. Have a chat with us today so we can review your portfolio with you.

* Returns based on S&P/ASX All Ordinaries Total Return Index and do not make any allowance for fees, costs or taxes. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Source: