What Wealthy Means to Australians in 2023

In Australia the legal age for being recognised as an adult is 18. A new report has just been released that was commissioned by AMP and completed by Bernard Salt AM and his team at The Demographics Group draws upon a range of demographic, social and cultural indicators sourced from Australian censuses extending, in some cases, between 1911 and 2021 discusses what it takes for middle Australians to feel wealthy. (Hint: it’s not all about money.).

Other data sourced from the Australian Bureau of Statistics and the International Money Fund is also cited. For interest, the report includes a timeline of event markers that tracks how middle Australia has changed since federation.

The report also draws upon selected data from the AMP 2022 Financial Wellness report. It also cites quotes and insights from a series of focus group discussions conducted for AMP by Fifth Dimension in Sydney, Melbourne and Brisbane in January 2023. Data and graphics have been prepared by data scientist Hari Hara Priya Kannan. The focus groups comprised Millennials, Gen-Xers and Baby Boomers.

Returning to the legal age for being an adult, the report has also said that Aussies aren't truly grown up until they are 28, and they're not old until they're 77. Modern society has also led to the 'rise of the individual', and wealth is no longer solely defined by the 'great Australian dream' of home ownership.

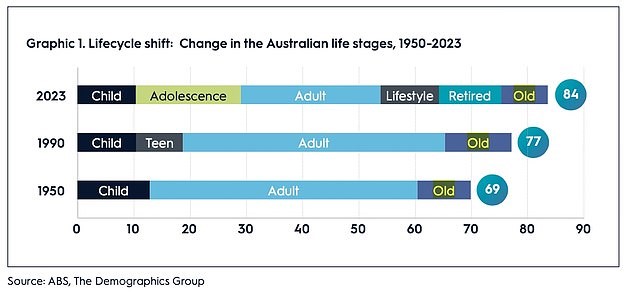

In 1950 there were just three stages of life:

- children aged 0 to 12,

- adults 13-60, and;

- the old, aged 61 to 69 - which was the average life expectancy at the time.

By 1990, the concept of being a teenager - 13 to 19 - was firmly established, 20 to 64 was the adult bracket and Australians were considered old from age 65. But in 2023 there are now six stages to the average life:

- childhood (0-12),

- adolescence (13-28),

- adulthood (29-55),

- a 'lifestyle' period from 56-64,

- the retirement era from 65-76, and;

- old age not typically kicking in until 77.

The adolescent period includes the extra time spent in education or training for higher skilled jobs, while the lifestyle period includes a time many spend combining work and leisure in semi or early retirement. The study said that while social change is usually slow to take effect, sometimes there are events that produce huge shifts. For example, the introduction of No-Fault divorce in 1975 meant that many Australians were freed from the burden of unhappy marriages. Mandated employer contributions (initially in exchange for salary increases) to superannuation starting in 1992 was designed to assure Australians of dignity and a level of independence in retirement.

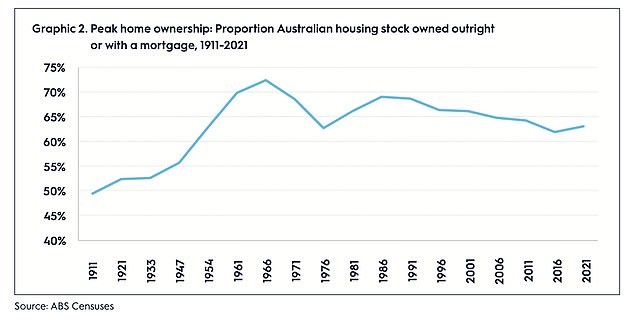

One of the most important social shifts has been the rise of the individual and in a direct comparison between the way Australians live in 2023 with the way we lived 60 years ago, in 1963 it is evident that that there is now more "alone time" across the lifecycle.' The research also found that home ownership rates have fallen from 73 per cent in 1966 to 63 per cent today.

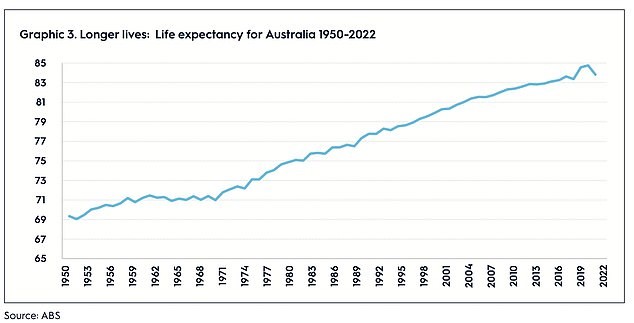

The report also shows that our grandparents died at 61, 62 in the 1950s and 1960s, the whole idea of retirement planning was not an issue because you died before you actually qualified for the age pension at 65. Many people in Australia who have or are about to enter into life after work are dealing with new concepts that are moving – there is no frame of reference that goes back 50 years. With greater life expectancy due to healthier lifestyles and modern medicine, the concept of preparing to fund what could be a relatively long period of time in retirement is relatively new. Across the world policymakers are struggling to grapple with the demographic realities of this massive change in the population but also because there's no corporate memory.

The report details how from the middle of the 20th century when the diggers were returning from World War II who had grown up during the Great Depression were very focused on home ownership because it brought a sense of security to their lives. Back then the life goals of getting married, having kids, buying a house, holding a steady job were values that shaped the times. In current day Australia the range of objectives now include home ownership, the pursuit of options like how and where we work, in how and when we form relationships and in how we choose to live our lives.

Reading the report reveals that whilst many things have changed, many have not. What has not changed is the value that people place on health, personal relationships, family, provisioning for children and of helping grandchildren.

This is the reason why we pursue security through wealth and why we have pursued these things in the past. 'Wealth however grand or modest enables us to live the lives we want to live, to benefit those we love, to support those we care about, both now and into the future.

Click on this link to read the full report - What Wealthy Means to Australians in 2023